South Shore has a rich history as both a place to call home and a place to venture for good food and friends. As a home for Black working families (including households earning low to moderate incomes) and public and private sector professionals, South Shore has been a stalwart. Threatening this identity is a national trend that South Shore has been unable to escape – displacement of families as a result of escalating rents and property taxes.

While some may celebrate the increased attention and investment in the area; the impact on low-income and working families, senior citizens on a fixed income, and persons with disabilities who struggle to find affordable accessible housing should provide a reason to question if there’s an alternative. South Shore, like many South and Westside communities of its time, experienced ‘white flight’ as the restrictive covenants were relaxed. However, while some communities struggled to build economically vibrant communities, South Shore effectively did so. Yet, over time, as residents found themselves competing for meager resources as the national and local economies experienced a down-turn – exacerbated by public policy that had a deleterious impact on predominantly communities of color, South Shore found itself struggling.

There is an opportunity in front of us to create a new model for development that doesn’t displace families with deep roots and ties to the community as a counter to the developer-driven frenzy taking place. Real estate listings cite properties more than 2 miles from Jackson Park as close to the Obama Presidential Center to entice buyers. Newlyrehabbed apartments that are actually near the proposed site for the Center and the re-imagined golf courses are being rented for double the previous rent. South Shore would seem to be on an upswing, but…at what cost?

National & Local Context

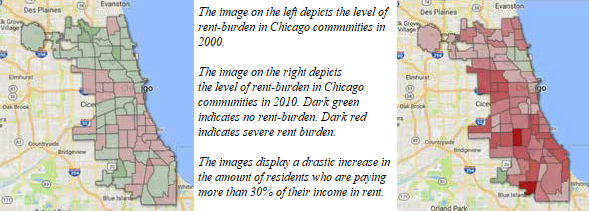

Placing South Shore in the broader context of a national and local housing crisis, there are economic and political factors that make the current housing situation extremely precarious for all residents, particularly African Americans – regardless of income levels, or political ideology. Since the mid-1970s, the gap between wages earned by employees versus employers began to grow considerably. Corporate CEOs now earn 380 times what an average worker earns, and 80% of the US population earns less than $65,000 annually – with 40% of the public earning less than $26,000. Bringing it back home to Chicago, the median income for Chicago residents is $52,497, while the median income for South Shore residents is $24,345. However, even with Chicago’s median income being more than double than income for South Shore residents, according to “Property Shark,” an online real estate data portal, the average Chicago renter leaves each month $1,115 in debt after paying rent. In other words, the effect of paying rent prohibits the average person from being able to effectively pay all of their bills.

Current Problems

While the obvious remedy is to build more “affordable” housing, as well as “public” housing, to accommodate severely rent-burdened households; unfortunately, it’s not that simple. First off, there are currently 180,000 new units of affordable housing needed to address the current demand. That amount of housing will take decades to produce and does nothing to help the current situation. Secondly, while the Chicago Housing Authority has prioritized releasing housing choice vouchers over construction (or rehab) of hard units of housing, because of the skyrocketing cost of rent, vouchers are unable to provide the same amount of housing as it once did. To illustrate the point, in 2005, the US Congress appropriated $5.1B to the US Department of Housing and Urban Development (HUD), which housed 1.5 million families. In 2017, Congress appropriated $10.8B (more than double the previous amount), which housed 1.2 million families – 300,000 fewer families than a decade earlier!

Lastly, because of too-few regulations in the residential rental market, there are unscrupulous real estate developers who exploit existing legislation and loopholes to amass wealth at the expense of our most vulnerable residents. The Better Housing Foundation received millions of dollars to provide affordable housing in the South Shore community, but in fact, has provided a lucrative revenue stream for attorneys and investors while residents were forced to endure deplorable housing conditions. Meanwhile, Pangea has become known as the eviction king, holding the largest number of eviction filings for Chicago, which journalists have argued in part of their business model to create volatility and high turnover in the residential rental market to amass revenue from fees associated with the move-ins and evictions in addition to the rent receipts. Adding insult to injury are the complete and virtually absentee landlords who care nothing for their residents, the neighbors, or surrounding community of their properties, such as the owners of the 7270 S. South Shore Dr. property that was condemned by court order.

Some Solutions

Who suffers in these instances are the families who are simply seeking a place they can call home, and the neighbors who are concerned about their livelihoods? Nevertheless, it doesn’t have to be this way. There are currently efforts underway to protect families from being victimized, but more is needed. The Lift the Ban coalition is actively working to repeal the existing Rent Control Preemption Act of 1997 that restricts any regulation on rent increases. The Coalition is also advocating for rent control, which would prevent rent increases from exceeding the consumer price index, i.e. rent couldn’t increase more than the rate of inflation. While mythology related to rent control has been promoted by the real estate industry for as long as rent control itself has existed, none of the arguments presented against rent control withstand scrutiny from empirical research or anecdotal stories. In fact, in cities like New York and San Francisco where skyrocketing rents far exceed what the average household can afford, rent control has prevented greater expulsion of low-income and working families. The Obama CBA Coalition is working to create a community benefits agreement ordinance for the Obama Presidential Center to, among other things, establish clear provisions for the creation and preservation of affordable housing to prevent families from being displaced as rents and property taxes continue to increase. An ordinance was introduced in Chicago’s City Council by the 5th and 20th Ward Alderwomen, Leslie Hairston and Jeanette Taylor in July. A recent research study produced by the Voorhees Center for Neighborhood and Community Improvement at the University of Illinois at Chicago has identified the increased vulnerability of renters and homeowners alike due to the rampant real estate speculation that has followed the announcement of the Obama Presidential Center site selection. We have an opportunity to protect housing for seniors on fixed incomes and implement strategies that are holistic and not result in displacement – but only if we fight for it. Talk to your neighbors. Engage your elected officials. Organize your community.

Jawanza Malone is the executive director for the Kenwood-Oakland Community

Organization (KOCO). He has been a South Shore resident for nearly 15 years.